Central Pacific back in black

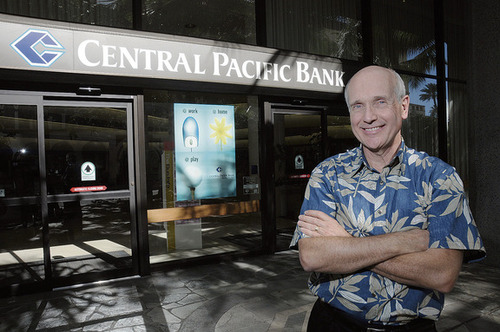

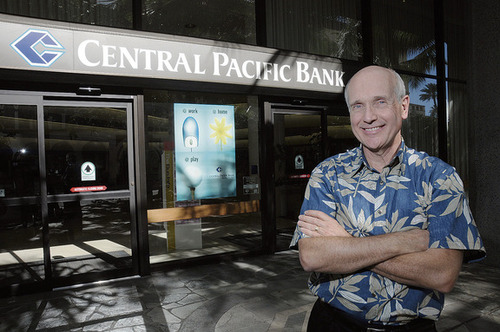

John Dean, president and CEO of Central Pacific Financial Corp., said asset quality improvements were responsible for its first-quarter profit but that "there's much more work to be done" for the state's fourth-largest bank.

The state’s fourth-largest bank improved its credit portfolio to earn $4.6 million last quarter.

Central Pacific Financial Corp. returned to profitability for the first time in two years as continued improvements in its credit portfolio last quarter helped the state’s fourth-largest bank earn $4.6 million.

FIRST-QUARTER NET$4.6 million YEAR-EARLIER LOSS$160.2 million |

The parent of Central Pacific Bank said yesterday it ended a string of seven straight losing quarters by reducing nonperforming assets by $18 million from the October-December period through loan pay-downs and charge-offs. It also released $1.6 million from a reserve that had been set aside for future loan losses.

"It’s a great way to start out the new year," said John Dean, president and CEO of Central Pacific. "A lot of progress has been made in the quarter, which was driven by asset quality improvements. That’s driving our turnaround right now. I think we’ve accomplished a lot, but there’s much more work to be done."

Central Pacific also made an $85.1 million accounting adjustment, stemming from the exchange of the company’s preferred stock issued to the U.S. Department of Treasury for common stock that was part of the bank’s recapitalization program. While the adjustment boosted the earnings per share to $4.58 from 18 cents, it did not affect the net income.

The normalized earnings per share of 18 cents easily beat analysts’ consensus of minus 18 cents.

Don't miss out on what's happening!

Stay in touch with breaking news, as it happens, conveniently in your email inbox. It's FREE!

In the year-earlier quarter, Central Pacific lost $160.2 million, or $107.23 a share.

"It was a surprise," said analyst Joe Gladue of Haverford, Penn.-based B. Riley & Co. "A lot of it has to do with the loan loss provisioning and they actually reversed some prior provisioning. That was a big help in reaching profitability."

Central Pacific’s stock closed up 23 cents, or 1.5 percent, to $15.54 on the New York Stock Exchange. The results were announced before the market opened.

Gladue, who had a "neutral" rating on the stock and was forecasting a loss of 45 cents a share, had said in a recent report that he didn’t expect Central Pacific to return to profitability until at least the third quarter.

"Improvement in asset quality is not smooth and there can be some lumpiness and things could move back to a loss (for a quarter)," Gladue said. "But they’ve certainly made great progress on asset quality fairly consistently and I would expect that improvement to continue over the remainder of the year even if there is a setback for one quarter."

The bank’s nonperforming assets last quarter of $284.9 million were an improvement from the $302.8 million as of Dec. 31, 2010, and $493.8 million in the first quarter of 2010. Nonperforming assets are loans that are not generating interest.

Central Pacific also reduced its net loan charge-offs to $13.3 million last quarter from $25.2 million as of Dec. 31 and $52.5 million in the first quarter of 2010.

"If you look at the last several quarters in terms of nonperforming assets, it’s really been primarily on the mainland and primarily in construction in both commercial and residential construction," Dean said. "So as those markets have stabilized, or should I say haven’t continued to be in a free fall, (Chief Credit Officer Bill Wilson) and his team have been able to make very good progress in reducing nonperforming assets."

Central Pacific, which had been in a cash-preservation mode until a $325 million recapitalization earlier this year, also has begun redeploying its liquidity into higher-yielding securities. That helped Central Pacific’s net interest margin, the difference between what it pays depositors and the interest income generated from loans, improve to 3.03 percent from 2.76 percent at the end of the fourth quarter. In the year-earlier quarter, the net interest margin was 3.20 percent.

Net interest income last quarter rose to $28.2 million from $27 million at year-end but was down from $35.1 million in the year-earlier quarter.

"The sequential quarter improvement in our net interest income and net interest margin was largely due to reduced borrowing costs resulting from the prepayment of $107 million worth of long-term borrowings at the Federal Home Loan Bank of Seattle in December 2010 and maturities of an additional $250 million of outstanding borrowings with the FHLB during the (first) quarter," Chief Financial Officer Larry Rodriguez said.

Noninterest income, which includes service charges and fees, was $12.5 million last quarter compared with $19.9 million at year-end and $12.8 million in the year-earlier quarter.

Total assets remained stable at $4 billion last quarter compared with $3.9 billion at year-end. In the year-earlier quarter, assets were $4.4 billion.

Deposits were virtually unchanged last quarter at $3.1 billion from year-end but down from $3.3 billion in the year-earlier quarter.

Total loans and leases were $2.1 billion compared with $2.2 billion at year-end and $2.8 billion in the first quarter of 2010.

Dean said that despite the profitable quarter, Central Pacific needs to get into a stronger earnings position before reinstating a dividend, which it abolished in January 2009.

"We need to continue to put numbers on the board in terms of consistent earnings and earnings growth over the next several quarters," Dean said.

"At that time, we can then reconsider reinstating our dividend. But not today and not in the near future."

Dean also said that May 6 is the last day for eligible shareholders to participate in a $20 million rights offering that allows them to purchase 1.3 shares at $10 each for every share they owned as of the Feb. 17 cutoff date. He said shareholders will receive the new stock about one to two weeks after the subscription period ends and those with questions are urged to call the bank.