Some help in understanding Social Security terminology

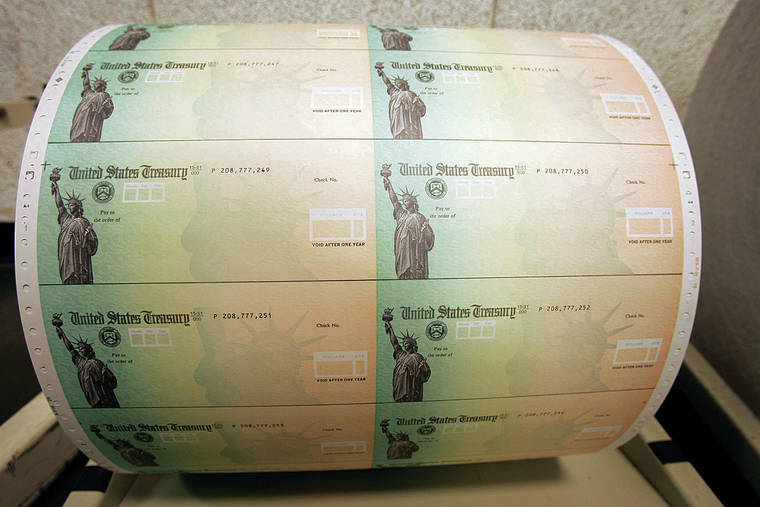

ASSOCIATED PRESS / 2008

If you’re nearing retirement, you should know the terms involving your benefit amount. Blank U.S. Treasury checks are seen on a roll before being printed and sent out to Social Security recipients, disabled veterans and federal retirees.

Some of the terms and acronyms (an abbreviation of the first letters of words in a phrase) people use when they talk about Social Security can be a little confusing. We’re here to help you understand all you need to know.

Social Security employees strive to explain benefits using easy-to-understand, plain language. In fact, The Plain Writing Act of 2010 requires federal agencies to communicate clearly in a way “the public can understand and use.”

If a technical term or acronym that you don’t know slips into the conversation or appears in written material, you can easily find the meaning in our online glossary at socialsecurity.gov/agency/glossary Opens in a new tab.

Social Security’s acronyms function as verbal shorthand in your financial planning conversations. If you’re nearing retirement, you might want to know what PIA (primary insurance amount), FRA (full retirement age) and DRCs (delayed retirement credits) mean. These terms involve your benefit amount based on when you decide to take it.

If you take your retirement benefit at FRA, you’ll receive the full PIA (amount payable for a retired worker who starts benefits at full retirement age). So, FRA is an age and PIA is an amount.

Once you receive benefits, you get a COLA most years. But don’t expect a fizzy drink — a COLA is a cost of living adjustment, and that will usually mean a little extra money in your monthly payment.

Don't miss out on what's happening!

Stay in touch with breaking news, as it happens, conveniently in your email inbox. It's FREE!

What about DRCs? Delayed retirement credits are the incremental increases added to the PIA if you delay taking retirement benefits beyond your full retirement age. If you wait to begin benefits beyond FRA — say, at age 68 or even 70 — your benefit increases.

If one of those unknown terms or acronyms comes up in conversation, you can be the one to supply the definition using our online glossary. Sometimes learning the terminology can deepen your understanding of how Social Security works for you. Discover and share more at socialsecurity.gov.

Beware of fake ads

Scammers have become more aggressive and sophisticated in the digital age. With millions of people relying on Social Security and Medicare, scammers target audiences who are looking for legitimate program and benefit information. Scammers sometimes try to scare people into giving out their personal information. Never give someone who called you any personal information unless you absolutely know who they are.

The law that addresses misleading Social Security and Medicare advertising prohibits people or nongovernment businesses from using words or emblems that mislead others. Their advertising can’t claim that they represent, are somehow affiliated with or are endorsed or approved by Social Security or the Centers for Medicare & Medicaid Services (Medicare).

People are often misled by advertisers who use the terms “Social Security” or “Medicare.” Often these companies offer Social Security services for a fee, even though Social Security offers the same services free of charge. These services include getting:

>> A corrected Social Security card showing a person’s married name.

>> A Social Security card to replace a lost card.

>> A Social Security statement.

>> A Social Security number for a child.

If you receive misleading information about Social Security, send the complete ad, including the envelope (if applicable), to:

Office of the Inspector

General Fraud Hotline

Social Security

Administration

P.O. Box 17768

Baltimore, MD 21235

You can learn more about how we combat fraudulent advertisers by reading our publication “What You Need to Know About Misleading Advertising” at socialsecurity.gov/pubs/EN-05-10005.pdf Opens in a new tab.

You can also view and share our anti-fraud information at socialsecurity.gov/antifraudfacts Opens in a new tab, as well as this YouTube video: youtube.com/watch? v= Opens in a new tab8N96ORODZm8 Opens in a new tab.

Remember, our information is easy to email and post on social media. Please let your loved ones know about these types of scams. Sharing this article with friends and family can save them from financial and emotional hardship.